Mar/08/10 11:28 PM Filed in:

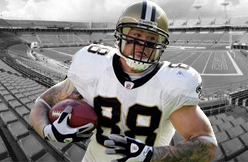

Jeremy ShockeyRecently released New Orleans Saints defensive end Charles Grant and current Saints tight end Jeremy Shockey have filed a lawsuit in U.S. District Court against their former teammate, Kevin Houser, alleging Houser duped them and other current and former Saints players and coaches into investing more than a million dollars in a film tax credit scam.

Houser is the former special teams long-snapper who was the longest tenured Saints player when he was cut by the team before the 2009 season as news of the tax credit fiasco emerged. Grant and Shockey say Houser, who was a licensed securities broker, convinced them they were buying state tax credits for Louisiana Film Studios, but later it turned out LFS had never applied for the state tax credits.

In all, nearly two dozen former or current Saints players and coaches, including quarterback Drew Brees, Coach Sean Payton and Saints legend Archie Manning, invested $1.7 million to buy what they thought were tax credits for the film studio project in Elmwood. Grant and Shockey's lawsuit is labeled a class action on behalf of the rest of the investors.

Houser's attorney, Jimmy Castex, said Monday his client and his wife were themselves victims of a scam by the film studio's former CEO, Wayne Read. Several local news outlets reported in January that Read had received a target letter from federal investigators and had asked a magistrate judge to appoint a criminal lawyer to defend him. Read's bankruptcy attorney, Robert Marrero, said he had heard that and believed it to be true, but couldn't confirm it for sure.

A federal bankruptcy judge ordered the film studio's assets liquidated last month.

Grant and Shockey's civil action alleges Houser engaged in unfair trade practices and, alternatively, unjust enrichment. The unjust enrichment claim is based on accusations about Houser's involvement in the film studio project. Grant and Shockey allege that Houser actually kept a portion of their money as a commission or finder's fee. Also, they say that Houser kept secret the fact that the film studio owed hundreds of thousands of dollars to 47 Construction LLC, a company co-owned by Houser and his wife.

Houser's jersey number with the Saints was 47. He played for the team from 2000 to 2008, exclusively snapping the ball on punts and placekicks.

Houser had brokered previous tax credit deals with his teammates, so Grant and Shockey expected Houser to put their money in escrow accounts until the state issued their tax credits, the lawsuit says. That did not happen, however, and the film studio project failed.

Grant and Shockey are asking the court to deem those who invested in the purported tax credits a class. The two suing players estimate that more than 100 people may have invested money with Houser or the investment firm he represented, Securities America Inc., on the deal.

In September, Castex told The Times-Picayune that his client was cooperating with federal criminal investigators who were looking into the case. A lawyer for George Ackel, the owner of the building that housed Louisiana Film Studios, also said he had been contacted by investigators.

Click here to order Jeremy Shockey's proCane Rookie Card.

(nola.com)