Bernie Kosar, the former quarterback for the National Football League's Cleveland Browns, filed a plan to satisfy creditors’ claims by liquidating his bankrupt companies and investments, while retaining some assets.

Kosar’s lawyers called the proposal a “hybrid” plan in which his companies’ assets would be liquidated to repay creditors and he would keep assets including his NFL pension and a vehicle, according to court documents filed Sept. 30.

Kosar’s ex-wife, Babette J. Kosar, wants the court to appoint a trustee to take over the case and liquidate his assets to distribute to creditors, saying in court papers “he has demonstrated no ability to manage his affairs,” and his “conduct constitutes gross mismanagement and/or fraud.” Babette is owed about $3 million from a divorce settlement.

In Chapter 11 documents filed June 19 in U.S. Bankruptcy Court in Fort Lauderdale, Kosar listed debt of as much as $50 million and assets of less than $10 million. Three of Kosar’s companies, KHOC LLC, BJK LLC and Mantua Land Co., also filed for bankruptcy.

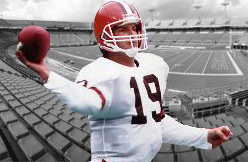

Born in 1963 in Boardman, Ohio, Kosar started his 12-year career with the Cleveland Browns in 1985. He finished second in almost all statistical categories for quarterback in the team’s history, according to the Cleveland Browns Web site. He earned a Pro Bowl selection in 1987, and set a league record in 1990 and 1991 by completing 308 passes without an interception. He led the Browns to the playoffs in each of his first five seasons.

‘The Drive’

Kosar played opposite Denver Broncos’ Hall of Fame quarterback John Elway in the 1986 American Football Conference Championship game, made famous by “The Drive,” which ended in a 23-20 overtime defeat for the Browns. At the University of Miami, Kosar led the team to its first National Collegiate Athletic Association championship, beating the Nebraska Cornhuskers, who had won 22 consecutive games.

Under his bankruptcy plan, Kosar would seek to hire CB Richard Ellis Group Inc.. to help auction and sell Mantua Land and BJK properties and repay their creditors.

Mantua Land owns four parcels of developed and undeveloped land totaling 315 acres in Mantua, Ohio. KeyBank NA holds a $3.1 million claim against Mantua Land for a mortgage on the assets.

BJK owns 140 acres of land in Fort Pierce, Florida, that was part of a proposed development called Creekside. National City Bank, BJK’s lender, is owed $4.3 million, and Creekside Community Development District is owed about $4.9 million from a bond offering.

Florida Panthers

KHOC owns a 6 percent interest in the National Hockey Leagues’ Florida Panthers valued at $14.4 million, according to court documents. After paying creditors KeyBank and Panthers Hockey LLP, which owns the Panthers, the proceeds of a sale would be used to pay Babette Kosar’s claim. The rest would be split among unsecured creditors and Kosar, court papers show.

Kosar expects to make about $24,000 a month from radio and personal appearances, and from providing services to companies such as Longaberger, court papers show. Kosar, who owes at least $15,000 a month for child support, estimates his monthly expenses at $13,800, leaving him about $11,000 to divide among his ex-wife and unsecured creditors.

(cleveland.com)